I am writing these words, looking back one year ago. Thinking of the beautiful moments with my love ones, happy days with smiling faces😊. I remember also moments that offered me new things to accomplish and other challenging activities saved on my to do list. When I am saying past I am referring to the period before COVID, and I want to tell you a little story about how are we as individuals and what we can do to improve ourselves.Basically we are all in the same game. Threats, opportunities and rules; and we are the only ones who will decide the right way for us. What makes us different is the way we are doing things, the way we tackle challenges, the ways we can adapt and grow.

CBD is a great evolving market that continuously adapts to consumer requests, trying to offer the best products and solutions to meet the market’s demands. But what is the market demanding? And more importantly at this point how can CBD merchants adapt quickly to offer and get the best?

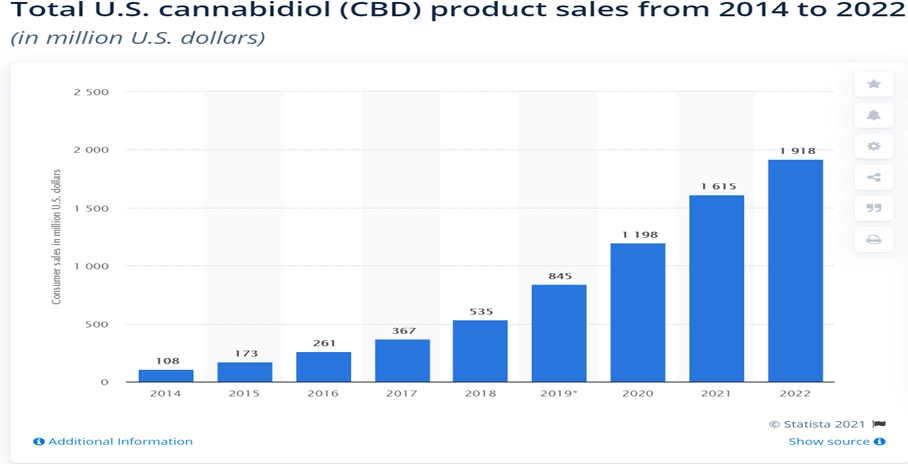

Looking for just 30 seconds at the chart below, you will see that CBD started in 2014 from $108M up to $845M in 2019, $1.1M in 2020 and is projected to grow to $1.9M in 2022.

A quick conclusion here from 2 points of view: the investor and the merchant. The investor has found a place where he needs to have his money – we are talking of a growth of 37% in 2020 vs 2019 / 33% in 2021 vs 2020 and 18% in 2022 vs 2021. The merchant on the other hand, must consider how to improve his operations and assemble the systems and organization to maximize his success. So now we are watching a great movie, where we are the actors and we can do something. We can run our CBD business effectively. We can have the best payment processing solutions, chargeback monitoring, 3DS service, suppliers and partners, to prepare ourselves for growth. And this is something significant because the trend is that the growth rate will decrease (2020 37% / 2021 33% / 2022 18%). Time is of the essence, and the time is now!

We are what we are and we adapt to life in the end as it is. In some cases the adapting process can affect us more or less depending on how we understand the change and the most important adversary is the person in the mirror. We can choose to face the challenge this market presents head-on, or site on the sidelines and watch as other companies grow their share in this emerging market.

As Big Tom Callahan said in the movie Tommy Boy, “You’re either growing or you’re dying… There ain’t no third direction.”

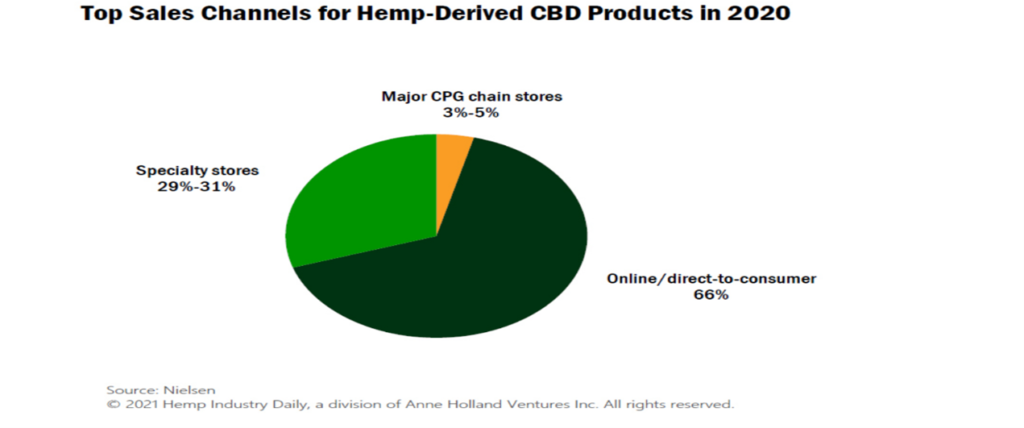

Given the relatively new legislation surrounding the CBD industry, credit card processing solutions are the most critical piece of the puzzle. Have a quick look at the figures below and think, really think of what could be. Think of what your business, your future and the future of your organization could be with the right payment processing solution, the right systems in place. So put in the time and grab your share of the CBD market.