After an 18 month hiatus, Affiliate Summit is back in a big way. If you’re a direct response merchant and you haven’t been to an Affiliate Summit show, you are missing out.

Category Archives: High Risk Merchant Accounts

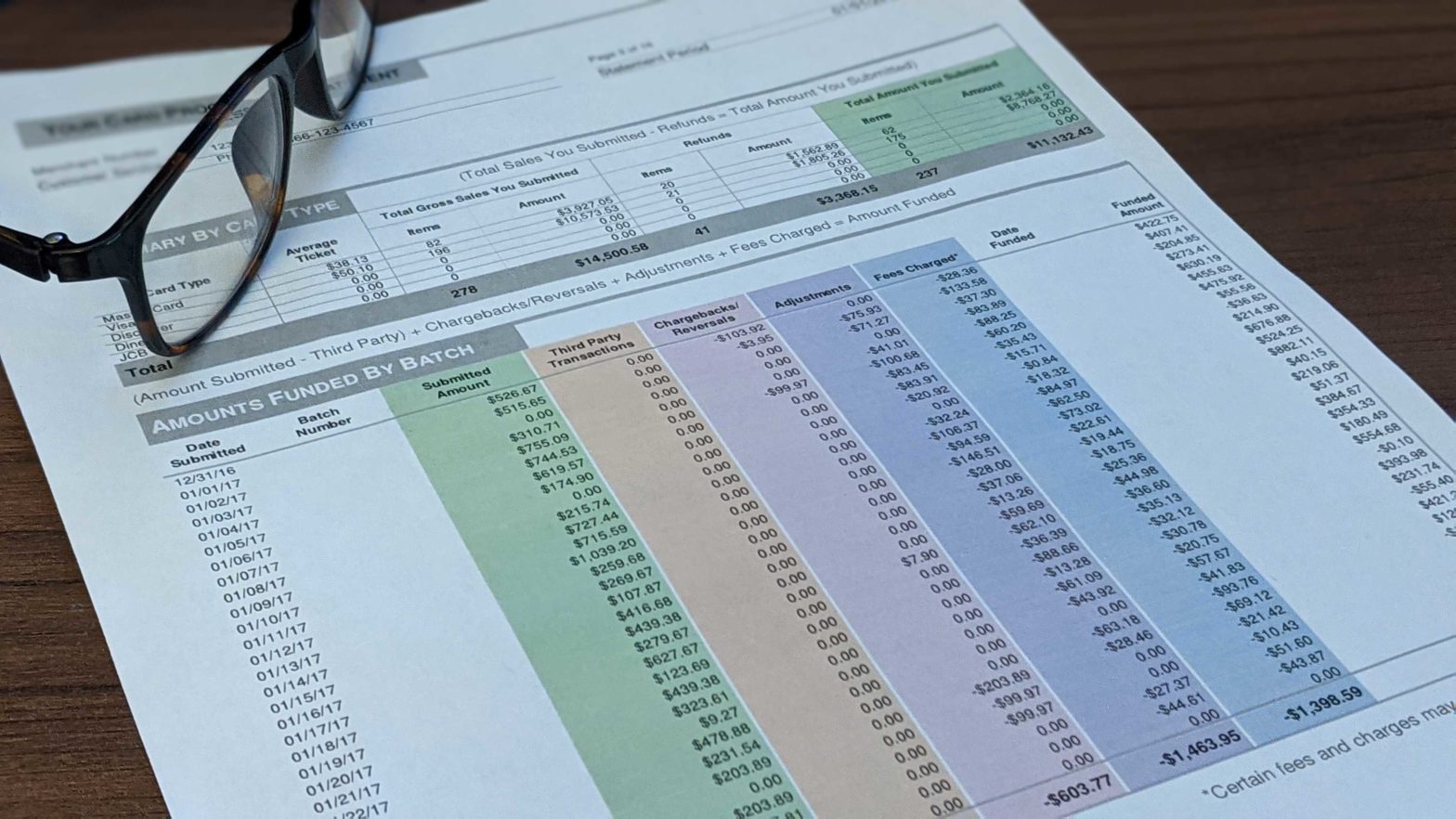

Understanding Credit Card Processing Statement Fees

In order to accurately read your merchant processing statement, it is important to understand that three parties are being paid for every transaction conducted. The first party is the major card brands, Visa, Mastercard, etc. These fees are called “card brand assessments” and they are 0.13-0.14% + $0.0155-$0.0195 per transaction. The second party is the …

Continue reading “Understanding Credit Card Processing Statement Fees”

Why is Using High-Risk Merchant Services Best For Your CBD Company

Cannabidiol (CBD) is one of the many chemical compounds from the Cannabis sativa plant. These plants are popularly known as marijuana or hemp. Unlike tetrahydrocannabinol (THC), the main ingredient in marijuana that causes the high, CBD is non-psychoactive. It is now gaining popularity for its antioxidant, anti-inflammatory, and pain-relieving benefits. CBD’s legalization More people can …

Continue reading “Why is Using High-Risk Merchant Services Best For Your CBD Company”

Midigator Review and Reporting

Fighting and preventing chargebacks to keep your MID healthy and durable is one of the most important aspect of one’s business. But how can you do that? The old fashion way of solving chargebacks one by one manually is time consuming, inaccurate, and ineffective. The first step to correct this is to find a specialist, …

The Real Story Behind Underwriting (How to compile a clean and complete underwriting package)

The term “underwriting” is typically used in references to banks or insurance companies or any institution looking to mitigate their risk exposure. Due to the above mention, you should expect that in the process of getting a processing merchant account the bank will follow the Five C’s of Credit: Character / Capacity / Capital / …

The Payment Processing Glossary

While completing a transaction is a relatively simple thing, pricing and terminology surrounding payments can be confusing and complicated. We’ve created this glossary as a guide to help you understand how payment processing pricing works. Account set up fee: A setup fee is an additional charge that covers the cost of setting up an account …