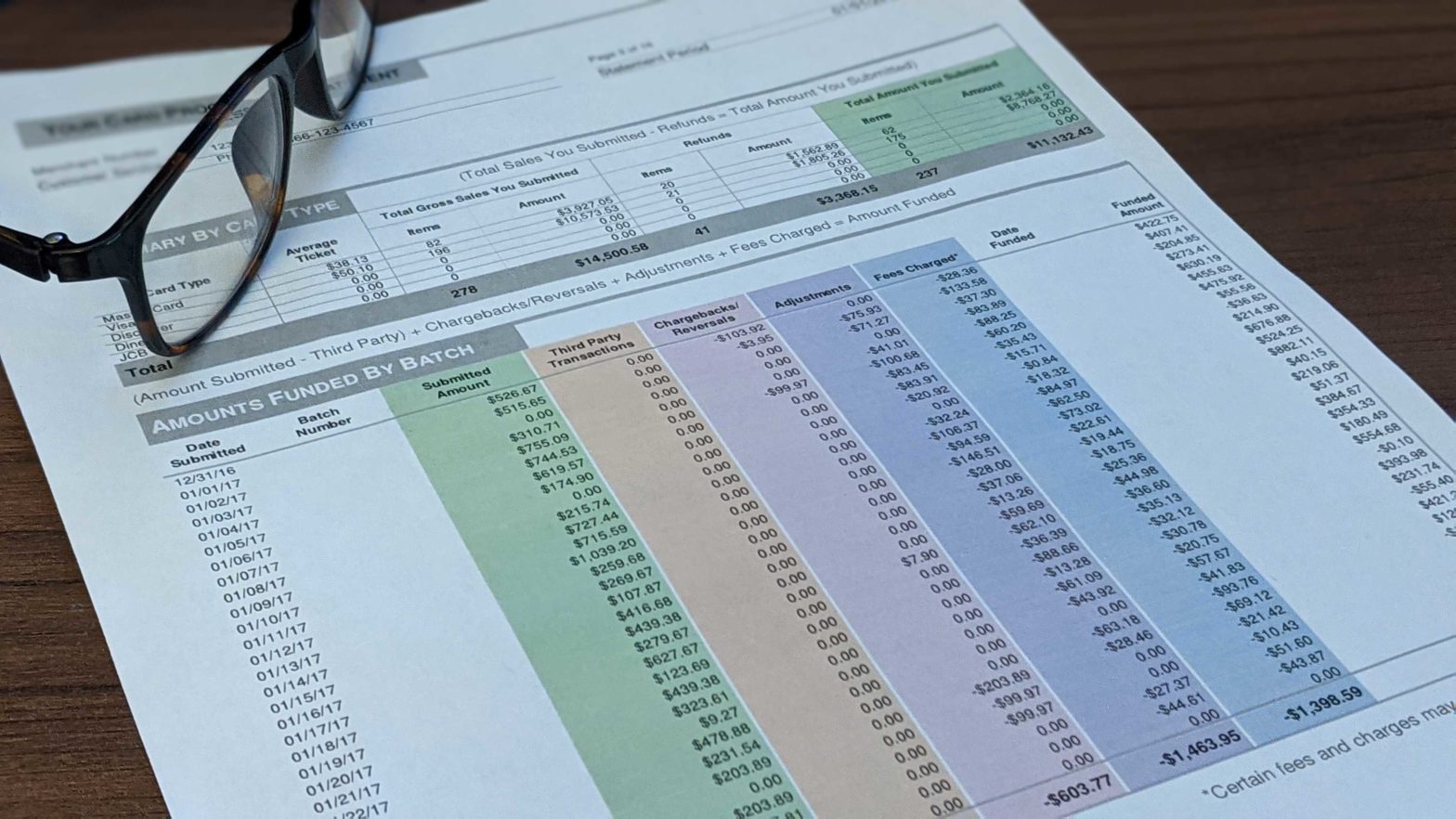

In order to accurately read your merchant processing statement, it is important to understand that three parties are being paid for every transaction conducted. The first party is the major card brands, Visa, Mastercard, etc. These fees are called “card brand assessments” and they are 0.13-0.14% + $0.0155-$0.0195 per transaction. The second party is the …

Continue reading “Understanding Credit Card Processing Statement Fees”