There is probably no better feeling for a merchant than when a customer buys, and loves your products. Profit is important too, but small wins can definitely boost your morale!

As much as a purchase can help your morale and your bottom line, a complaint, or worse, a refund, can hurt it. Refunds are part of business, and there’s no way to avoid them.

There is something worse than a refund though. Chargebacks are also yet another unavoidable part of the business world, but these can be a bit more damaging. Oftentimes people may confuse refunds with chargebacks, but they are not the same thing.

So what is a chargeback and how does it differ from a refund?

Simply put, a refund is when a customer requests their money back from the merchant, and the merchant accepts and returns their money.

A chargeback on the other hand, is when the customer contacts their bank, instead of contacting the merchant, to get their money back. This typically happens after the merchant has declined to issue a refund. You can learn more about the chargeback process here. Suffice it to say, at the end of the process there is rarely a winner.

Once a chargeback has been filed, the merchant is assessed a fee, regardless of whether the merchant or the customer wins the chargeback. If the merchant loses the chargeback, the merchant must refund the money to the customer, in addition to paying a chargeback fee. And, by the way, if you get too many chargebacks as a merchant, your merchant account could be terminated.

In order to understand how to prevent chargebacks, we need to understand why chargebacks happen in the first place. Fundamentally, there are several different types of chargebacks, and they typically fall into one of 4 categories.

- Criminal fraud

This is when a fraudster accesses a customer’s account and makes an unauthorized purchase, leading the customer to contact the merchant or directly contact their card network.

- Friendly fraud

This is when a customer makes a deliberate attempt to get their money back, even if they received their product, and were satisfied with it. They may contact the merchant, or just go straight to their card issuer. Friendly fraud is one of the leading causes of chargebacks.

- Merchant error

This is when the merchant makes a mistake on the product delivery, and delivers a product that was not as described. Basically, the merchant is in the wrong here, and needs to remedy the situation by delivering the product, or giving a refund. This goes hand in hand with customer support. If your support team isn’t proficient in resolving complaints, they could be inadvertently be adding to your chargeback woes.

- Affiliate fraud

Affiliate fraud is another serious contributor to chargebacks. Frequently, affiliates will display inaccurate pricing, terms or even product descriptions, in order to entice consumers to buy your product. You pay the affiliate for the sale and several weeks later, your customer charges back because your affiliate promised them something you can’t or don’t provide.

Now that we understand what causes chargebacks, lets see what we can do to fight them. Here are 8 practical ways to reduce chargebacks…

- Set up Ethoca and Verifi alerts

A simple and effective way to get started on reducing your chargebacks comes down to leveraging an effective alert system before the dispute happens.

Luckily there are two, and they’re well known.

There’s Ethoca alerts, which is from Mastercard, and Verifi, which is from Visa.

Basically, these are two alert systems that give merchants a notification for when a customer attempts to do a dispute with their bank.

From there, the dispute gets paused, and the merchant is given a brief amount of time to either decide to issue a refund to the customer, or decline the refund and likely move forward with chargeback representment. Typically, as most merchants know, a refund is the best route to go, but there are exceptional cases that can happen from time to time.

This is why thankfully, Visa and Mastercard acquired these technologies, and this is especially timely considering the rise of eCommerce and Card Not Present transactions.

2. Offer refunds to dissatisfied customers

Typically if a customer is dissatisfied, it is for a legitimate reason. Customers want the product they paid for, not a fight with a merchant.

Sometimes however, there are exceptional cases, and there are customers who may try to abuse your services. And obviously if the reason is legitimate, such as dissatisfaction with the product, offer a refund or an alternative.

But, the same goes for supposedly illegitimate reasons too.

It may suck to do, but it’s often better to just refund their money, and avoid a chargeback. The odds are already stacked against you when it comes to chargebacks, and even if you do win, you’ll still have to pay fees.

So with this in mind, you need to do everything you can to avoid disputes in the first place.

This is why it’s important to make sure your refund policy is clear, and to have terms and conditions available on your website that are within the consumers rights of your jurisdiction.

But if they still have a dispute, this is why it’s also important to have a quick response time and good customer service. If no one answers the phone or emails for more than a day, many cardholders will likely do a chargeback, with some even doing it the same day.

With that being said, if you’ve made your terms clear, you have good customer service, but they are still unwilling to negotiate an alternative, the best thing to do is just give them the refund to avoid further escalation of the situation.

3. High chargebacks? Change your billing model

Your product is one of the most important factors behind getting chargebacks, but it’s not the only one.

Your billing model could also be part of the problem.

This is because it depends on the market you are working with, and if you’re in the high-risk space, things can get especially tricky.

Just keep in mind that if you’re selling products on a trial basis, your “14-day trial” could be leading to high chargebacks. Consider changing your billing to a straight monthly subscription, with no trial.

This is especially important to do if you notice your customers forget often. You can do several email reminders before the trial ends to help them remember their original purchase and reduce the chances of a chargeback.

Doing reminders is a key tactic that can reduce your chargebacks, as you’ll see in the next point, but the details about how you bill your customers matters too.

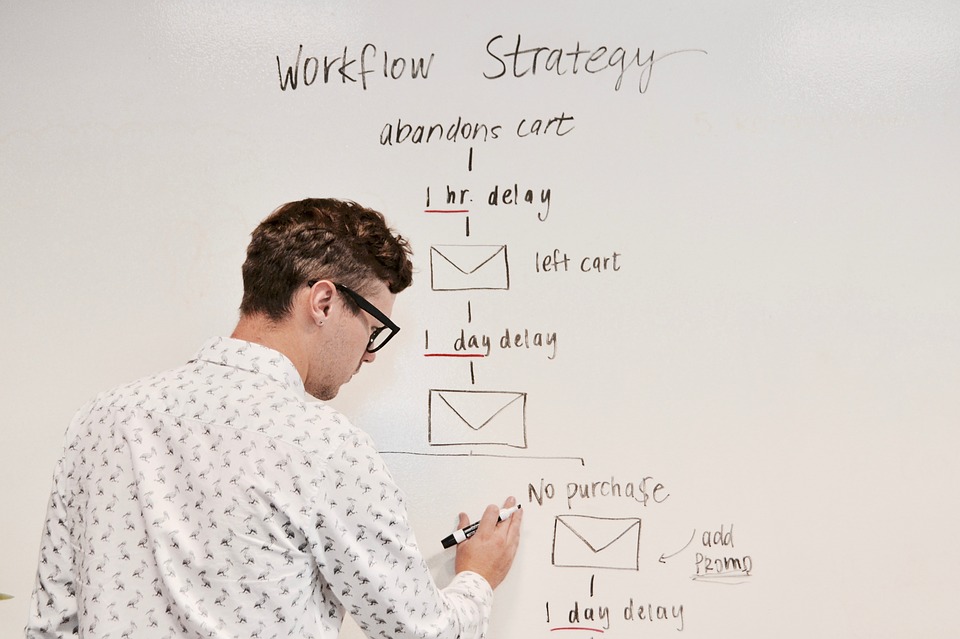

4. Be transparent about your billing cycle

Another common reason chargebacks happen is transparency about your billing cycle.

If you aren’t clear about when the bill will be processed, it is very likely that your customer will be caught off guard when it happens.

So, if you are using subscriptions to bill your customers, do everything possible to notify them up front that there is a subscription, and notify them each month when their bill will be processed.

And relating to the last point, you can also do email reminders before the next bill to reduce the chances of a chargeback. Typically 7 days before is a good amount of time to notify your customers, and it’s also important to be on the lookout for cards that have just expired.

Bottom line, the more upfront you are about billing, the less chances there will be a problem.

5. Check your billing descriptors

This is often overlooked by merchants, but recently, many payment processors have caught onto this and now offer solutions to easily fix it.

Your billing descriptor can in itself cause chargebacks.

So what exactly is a billing descriptor? Simply put, it’s an explanation on your customer’s credit card statement that lists details about the transaction. An explanation shouldn’t be a problem, but it can be if it is vague and looks scammy.

For example, if your company is named Bob’s Tools, Inc, and on the bill it says “randomcompany.LTD”, your customer will likely get confused about this.

Sure your parent company could be RandomCompany.LTD, but they probably won’t know that, and they most likely won’t even bother to check. They’ll likely suspect fraud, and just go straight to their bank to do a chargeback; This is especially true if it’s a larger amount.

So how do we fix this? It’s pretty straightforward.

Your billing descriptors should be checked at least once a quarter to make sure that they are accurate, and it should at a minimum include your website address and your customer support number. So our friend Bob’s descriptor might look something more like BOB’S TOOLS 888-888-8888 once he’s fixed it.

6. Use 3D Secure to stop friendly fraud

As mentioned in the first tip about setting up Ethoca and Verifi alerts, having an alert system is great to prevent chargebacks. But what should you use to prevent friendly fraud chargebacks?

If you want to prevent fraud, there’s a powerful tool out there that can help prevent it:

3D Secure.

Sometimes known as 3DS, 3D Secure is a global security protocol used by card networks to protect merchants from fraud, and it’s an additional security layer used to authenticate online card-not-present transactions, prevent Account Takeover (ATO), and also friendly fraud.

It does this by sending authentication information to the card network’s bank, and by verifying if the cardholder’s credentials match the ones at their bank. It’s called 3DS, because it consists of the merchant or acquirer’s domain, the interoperability domain and the card issuers domain.

With that in mind, this is great news for merchants for three reasons:

- Once a transaction is authenticated using 3DS, it limits the cardholder’s ability to do a chargeback.

- 3DS transactions are viewed as lower risk from banks, thus allowing you to qualify for lower interchange fees.

- It can sift out a clear fraud attempt very quickly.

You can learn more about 3DS and its other benefits here.

7. Use fraud prevention tools to prevent criminal fraud

Fraud has been on the rise in the last few years, and has been absolutely exacerbated since the advent of the pandemic.

With more transactions shifting online, you have to ask yourself what you’re doing as a merchant to help protect your customers from fraudulent activities, and a big part of the solution is using fraud prevention tools and methods.

Some examples can include:

- AVS

The Address Verification Service, or AVS, is a tool that allows merchants to easily verify addresses in order to detect and prevent credit card fraud and suspicious transactions. If a match or partial match is found between the customers billing address and the card issuer’s records, the transaction will be processed without a problem. This is a quick and easy automated way of avoiding fraud and chargebacks in the first place.

- Fraud blacklists

You could take a guess as to whether or not a transaction was fraudulent, or, you could use a blacklist to help give you a clue. Many times fraudsters don’t just stop at one transaction, but will often come back for more. This is why having access to a blacklist of known fraudsters with their attributes is invaluable to prevent fraudulent transactions and chargebacks.

- Geolocation

Using geographical information can be very useful when trying to prevent fraud as well. If you have had fraud occur several times from a given area, or you notice addresses that don’t line up with the customers billing information, this may be a red flag. This is why geolocation can be great to also gather evidence of a potential fraud.

- Device fingerprinting

Card information, lists and locations can all be helpful, but what if you use the characteristics of a device to identify a customer? This is what device fingerprinting does. It’s basically the process of getting specific signature information about a device to help identify it. This can include details like the operating system and any other settings that the user sets in the device, and it’s important to note that this method is different from cookies, as the information is stored on a company’s server, and not locally.

- Velocity checking

This is yet another fraud detection tool that every merchant needs to use. If a buyer submits multiple transactions in a short amount of time, this could indicate fraud, and this is because fraudsters will typically try to spend the maximum limit on a card as soon as they get one. In short, this tool can easily expose fraud in the moment it happens.

8. Outsource your chargebacks to a qualified chargeback representment firm

So by this point, we’ve gone over 7 ways to prevent chargebacks, and each of these can prove to be beneficial to reducing your chances of chargebacks occurring.

However you also need to consider by how much they can reduce your chances…

You have to face the fact that preventing chargebacks on your own is hard, and that the room for error is very slim. Maybe you know some details about the chargeback representment process, but you have some doubts…

This could spell losses on top of losses, especially if you’re in the high risk space. This is why it’s a good idea to outsource your chargebacks to a qualified chargeback representment firm.

At Helios Payments, we know chargebacks inside and out, and not only will we help you win disputes, we’ll also give you the tools needed to mitigate their damage, such as:

- Detailed analytics to help you identify problematic affiliates

- Chargeback reporting based on billing cycle, card type, BIN and more

- 3D Secure authentication

And let’s face it, if you don’t understand the game, you stand little chance of winning at it. When you work with experts, you’ll get the right tools and knowledge to not only win disputes, but to do even better: Prevent chargebacks in the first place.

Summary

So in short, chargebacks and refunds are a part of business, and they at some point will inevitably happen. However, there are some things you can do to reduce the chances of them occurring, and minimize the damage in the process.

A refund can feel terrible to give, but a chargeback can hurt your monthly chargeback ratio and ultimately the status of your merchant account with your bank.

At the end of the day, you need to use tools to protect your business from fraud, know the ins and outs of your billing, and be attentive to your customers needs, and in the worst case, their complaints.

And if this sounds like a complicated process with many steps, you’re right, it is.

Want to reduce chargebacks in a simple yet effective way? Click here to learn more…