What most agents don’t know is that there is a whole world of high-risk, high-margin merchants out there, looking for help to find a ‘risk-friendly’ bank. On high risk deals, its typical to see 100-200bps (1-2%) of margin on a high risk deal. For the math geeks out there, that’s 70-180bps more than a low risk deal… in other words, high risk deals can be 3-10 times more profitable than low risk deals.

Author Archives: Josh Ewin

Is Your Chargeback Strategy Intelligence Driven?

It’s pretty clear to most merchants that the pandemic has caused disruptions not only in the health care system, but in the economy as well. More specifically, this new normal has created a breeding ground for increased instances of friendly fraud, which have been undoubtedly hurting the chargeback ratios of many merchants. Chargebacks are expensive, and …

Continue reading “Is Your Chargeback Strategy Intelligence Driven?”

Can You Save Money Managing Your Own Chargebacks?

When I ran my skincare company, chargebacks were one of the most critical KPIs for our team to follow. They affected our bottom line. They also told us things, like what affiliates sucked and needed to be tossed to the curb. More importantly, they were an existential threat to our merchant accounts. I can tell …

Continue reading “Can You Save Money Managing Your Own Chargebacks?”

Affiliate Summit East 2021 Wrap Up

After an 18 month hiatus, Affiliate Summit is back in a big way. If you’re a direct response merchant and you haven’t been to an Affiliate Summit show, you are missing out.

Use it or lose it – Chargeback Alerts

Ask any online direct-to-consumer merchant, and they’ll tell you that dealing with chargebacks is one of the most challenging aspects of the business. Online sales are always “card not present”, which makes it easier for friendly fraud and chargebacks to occur. Many direct-to-consumer merchants sell subscriptions or trials for their products, which adds to the …

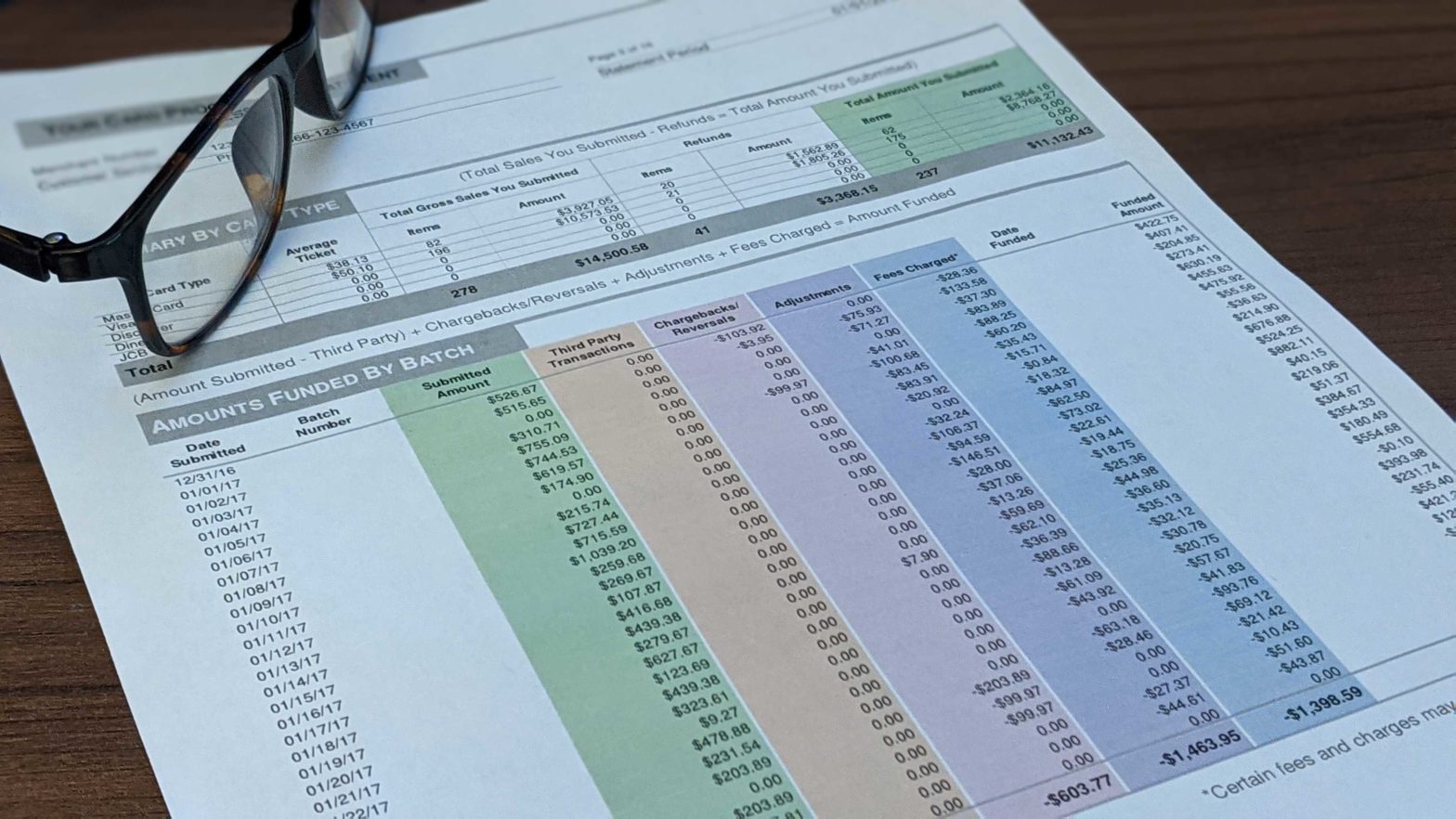

Understanding Credit Card Processing Statement Fees

In order to accurately read your merchant processing statement, it is important to understand that three parties are being paid for every transaction conducted. The first party is the major card brands, Visa, Mastercard, etc. These fees are called “card brand assessments” and they are 0.13-0.14% + $0.0155-$0.0195 per transaction. The second party is the …

Continue reading “Understanding Credit Card Processing Statement Fees”