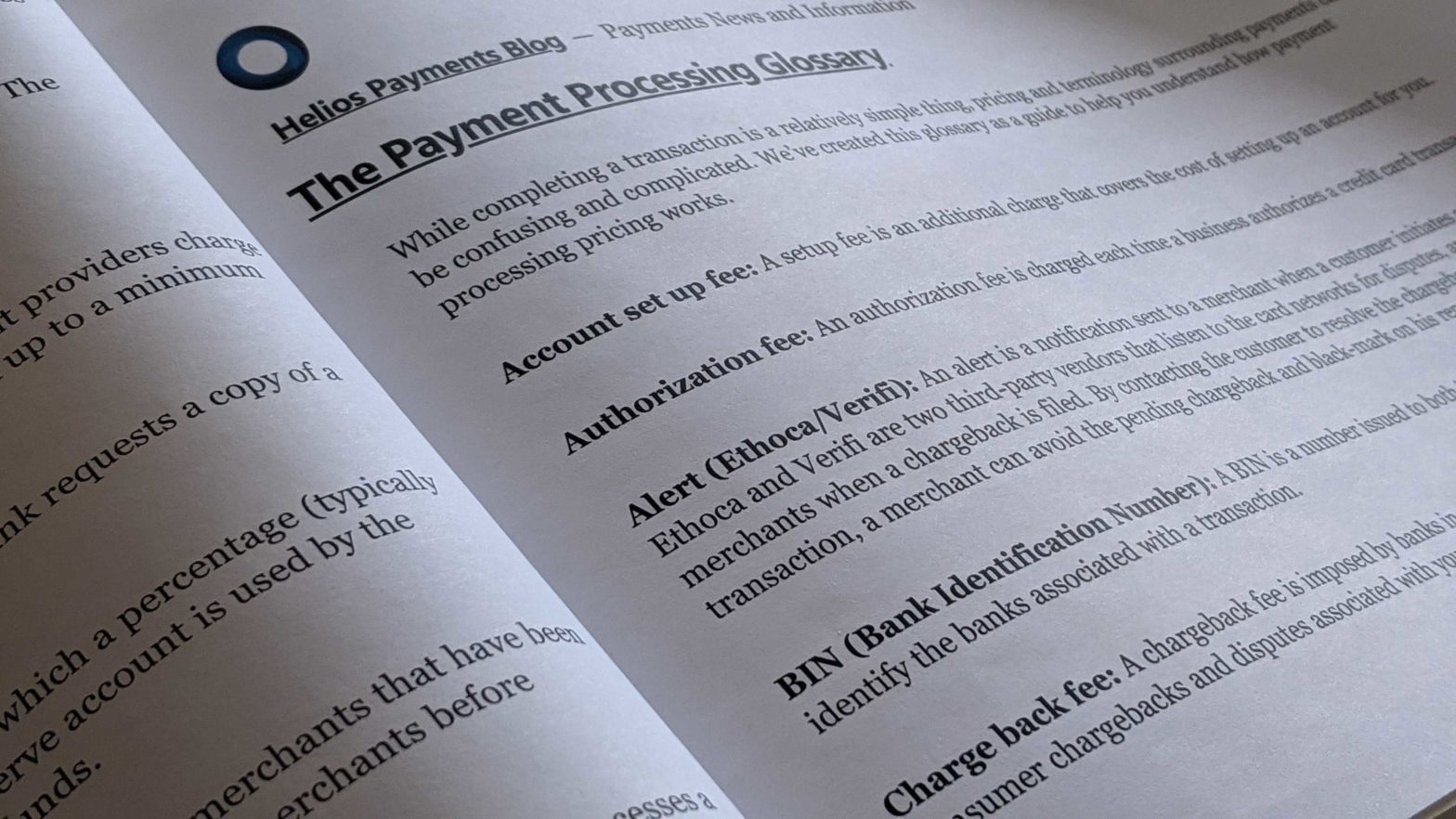

While completing a transaction is a relatively simple thing, pricing and terminology surrounding payments can be confusing and complicated. We’ve created this glossary as a guide to help you understand how payment processing pricing works.

Account set up fee: A setup fee is an additional charge that covers the cost of setting up an account for you.

Authorization fee: An authorization fee is charged each time a business authorizes a credit card transaction.

Alert (Ethoca/Verifi): An alert is a notification sent to a merchant when a customer initiates a chargeback. Ethoca and Verifi are two third-party vendors that listen to the card networks for disputes, and alert subscribed merchants when a chargeback is filed. By contacting the customer to resolve the chargeback, or refunding the transaction, a merchant can avoid the pending chargeback and black-mark on his reputation.

BIN (Bank Identification Number): A BIN is a number issued to both issuing and acquiring banks, used to identify the banks associated with a transaction.

Charge back fee: A chargeback fee is imposed by banks in an effort to recover incurred costs while handling consumer chargebacks and disputes associated with your account.

Discount fee: fee paid by merchants to credit card processors as a fee associated with accepting general-use credit cards (such as Visa, MasterCard, American Express and Discover).

Electronic AVS: The Address Verification Service (AVS) is a tool that enables merchants to detect suspicious credit card transactions and prevent credit card fraud. AVS verifies that the billing address entered by the customer is the same as the one associated with the cardholder’s credit card account.

EMV 3D Secure: 3D Secure is an additional level of authentication that reduces ‘friendly fraud’ by generating a digital ‘fingerprint’ of the customer, to confirm that the customer (and not someone else) is completing an online transaction. For European merchants, using 3D Secure can help to achieve PSD2 Compliance.

Gateway: For e-commerce merchants, a gateway is a program that links the merchant’s merchant account with the merchant’s online shopping cart. It is the virtual equivalent of the payment terminals used by retail merchants to allow customers to swipe their cards to complete a transaction.

Industry non-compliance fee: Some merchants may also be charged a PCI non-compliance fee, if they fail to maintain proper security standards and procedures as outlined by the PCI DSS (Payment Card Industry Security Standard).

MATCH List: The MATCH list is a list of terminated merchants, used by Mastercard and American Express for screening during the merchant approval process.

MID (Merchant ID): A MID is a number issued to a merchant upon approval of a merchant account. The merchant’s acquiring bank BIN is used for the first 6 digits of the Merchant ID.

Monthly fee: Monthly Fee is a monthly recurring charge that you will be billed each month.

Monthly minimum: Often referred to as just a “Monthly Minimum,” most merchant account providers charge a Minimum Transaction Fee if the total transaction processing fees for the month do not add up to a minimum amount.

Retrieval fee: A retrieval fee is charged when a customer or the customer’s issuing bank requests a copy of a sales draft in order to substantiate a transaction.

Reserve account: A reserve account, is a non-interest bearing account, into which a percentage (typically 10% of net transactions) is placed for a period of time (usually 6 months). A reserve account is used by the merchant’s bank as a way to offset the risk associated with chargebacks and refunds.

TMF (Terminated Merchant File): A terminated merchant file, is a shared list of merchants that have been terminated by their acquiring bank. The terminated merchant file is used for screening merchants before approval for a merchant account. See also MATCH List.

Transaction fee: A transaction fee is a per transaction fee that a business has to pay every time it processes a customer’s electronic payment.

Virtual terminal: A virtual terminal is a way to manually enter credit card transactions. Usually a merchant’s gateway will provide a virtual terminal, in addition to the API gateway, to allow the merchant to place transactions manually.

Voice authorization: Voice Authorization is a security measure used by the credit card industry to ensure that a particular purchase is being authorized by the actual card holding customer.

Voice AVS: The fee applies whenever you access the address verification system (AVS) when processing a transaction at your business.