It’s no secret that the public perception of cannabis has become more favorable in recent years.

Cannabis is no longer considered just to be a plant where marijuana can be derived from to smoke, as it has become a source of curiosity in the scientific community about its purported health benefits.

In 2015, legislation was passed in order to loosen regulations regarding marijuana research under the Obama administration, and in doing so, they have brought us that much closer to discovering the truth about this potentially helpful plant, while also opening up potential research on products derived from it as well.

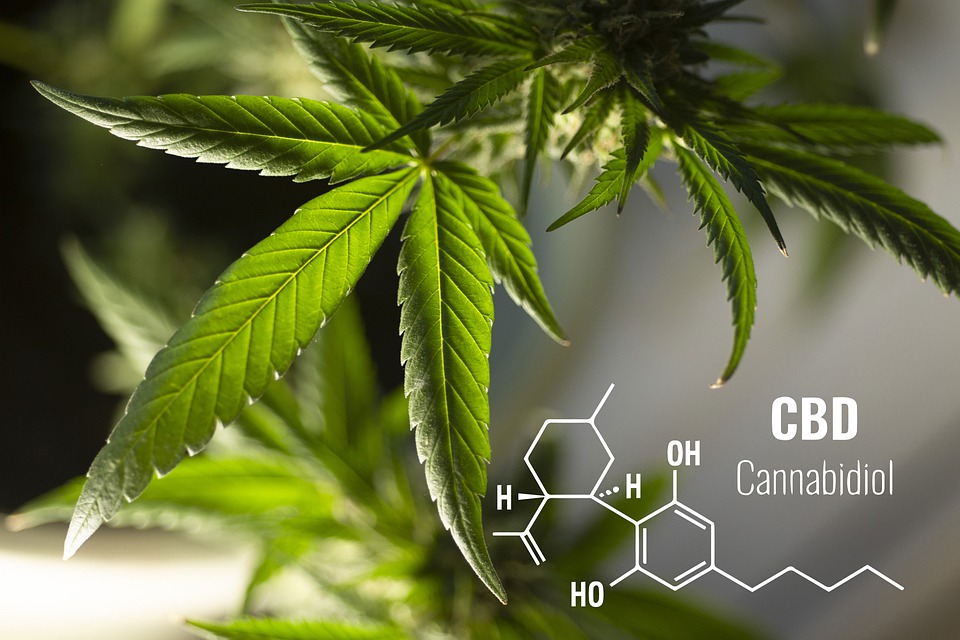

Marijuana, cannabis, hemp and even CBD are all terms that are used interchangeably within mainstream discussions about the topic, but there are some definitions and fine lines to be aware of.

Simply put, Marijuana is cannabis that has more than 0.3 percent of THC by dry weight, while Hemp has less than 0.3 percent THC by dry weight. With a level higher than 0.3 percent, Marijuana could get you “high”, while hemp may have little to no psychoactive effects. CBD, or cannabidiol on the other hand, is an active ingredient in cannabis, and on it’s own cannot get you high or make you chemically dependent on it. This was found by the World Health Organization’s 2017 pre-review report on Cannabidiol.

Because of these facts and loosened FDA restrictions on research, a green rush has started within the cannabis industry, with CBD being found to be more palatable for mainstream consumers considering that it does not require smoking or getting high to reap its benefits.

And considering that you are reading this, you are probably thinking about starting a CBD or cannabis related business.

But, do you have a bank that will accept you, considering you’re a high risk merchant?

In this article, we’ll explain why finding a CBD friendly bank can be a challenge today, the current legal status of CBD in the US, why the Green rush can cause confusion for banks, and we’ll cover some of the key steps to finding a CBD friendly bank.

1.Consider your jurisdiction and current laws

This is the first thing you should consider when trying to find a CBD friendly bank.

The law will be crucial in determining your course of action moving forward, so ask yourself, “What are the laws pertaining to CBD where I reside?”, because this will shape your strategy moving forward.

Also, the better you adjust your strategy according to the jurisdiction your CBD business is in, the better equipped you’ll be to deal with the legal ambiguity under certain state laws that can make CBD friendly banks and payment processors avoid you.

Although Cannabis is growing in favorability among the public, we still need to remember that it’s currently a gray market.

Things started to shift a little more favorably with the 2018 Farm bill under the Trump administration, as it removed hemp from the DEA’s Schedule 1 controlled substance designation, but again, this legalization applies to the federal level and states do not necessarily have to comply.

Because of this, some states may still consider keeping Cannabis illegal to grow, sell and consume…

Bottomline, selling CBD derived from Marijuana is illegal because of the THC contents being over 0.3%, while CBD derived from hemp that is under 0.3% is not. With this information in mind, merchants will need to prove that their products contain legal levels of THC, and this is best achieved by having current Certificates of Analysis (COAs) for every CBD or hemp product being sold.

One common CBD product consumers love are distillates or oils.

Recently, there have been new distillates such as Delta-8, Delta-10 and Delta-O, which are all hemp derived isomers of Delta-9 THC. These products may prove to be lucrative for your business, but things can get tricky, especially considering that Delta-9 THC is the psychoactive ingredient in cannabis.

Currently these products have been legalized at the federal level, but there is some disagreement within specific states. Tread carefully if you sell these products, but also remember that there could be opportunities on the horizon if the federal government moves to regulate them in the future.

2.Issues that currently face eCommerce CBD retailers

It would seem reasonable to believe that due to the growing popularity of CBD products, online platforms would favor or encourage business within this field, but this currently isn’t the case.

Things can be tricky for eCommerce CBD retailers at this time, and it comes down to a few main things…

For starters, it can be hard for CBD retailers to find reputable financial services, because many MSP’s and credit card companies are afraid of legal liability due to the volatile nature of Cannabis laws.

And as much as the green rush continues to grow, there seems to still be a limited amount of options available, and with this shortage comes increased fees and variable business practices.

They probably know that mainstream banks and payment processors are unlikely to do business with you, and because of this, they may take advantage by overcharging you, and also changing their terms of service on a short notice, potentially jeopardizing your business operations.

Brick and mortar CBD retailers face similar problems, but they can at least accept cash. Keep in mind though that the risk of theft can increase with holding cash, and that many banks and/or credit unions will charge extra fees for armoured transportation.

Similarly, with online purchases, this is especially a tricky situation. Stripe, Visa and Paypal won’t process cannabis transactions, and because of this, some eCommerce stores use money order or pay by check.

These two options can present their problems though, as cheques can bounce, and money orders have extra fees that can create friction in the sales process…

And as mentioned earlier, there are conflicting laws on a state and federal level in addition to the other legalities that swarm this trending industry.

To make matters worse, advertising your CBD products online isn’t exactly easy either, because regulations on advertising platforms can be limiting and even restrictive.

Facebook and Instagram do not allow you to mention CBD in your ads, and they restrict you from making any serious medical claims. So you can still promote your CBD product, but you just have to make sure that you play by the rules, which can be a fine line…

And in terms of Google, they currently don’t allow the promotion of CBD products derived from cannabis, but it may be okay if it is derived from Hemp. This is a big IF, and you should proceed carefully to ensure that you won’t violate any of their other terms regarding pharmaceuticals, because it can lead to an indefinite account suspension.

3.Do your research

After considering the legalities and potential issues you may face in the eCommerce space, the next step in your journey to finding a CBD friendly bank is researching potential banks.

As simple as it may sound, it starts with a simple internet search.

You want to search for banks that are affiliated with this space, and take note of banks that are mentioned to be CBD friendly. It can be hard to find traditional banks that are okay dealing with high risk merchants, especially with Cannabis, so you may find that there are less options and more hoops to jump through. You may also find that many are credit unions instead of traditional for-profit banks, but don’t let this deter you. Credit unions can be just as helpful!

As you do further research, you should consider what the bank’s risk tolerance is, and whether they have some reservations. You want to also assess how well they monitor regulations, because the Cannabis industry is quickly shifting and very volatile. Also ask yourself, “When things do shift, how well do they adapt to new regulations?”

This is a key component to consider when choosing a bank.

In addition to monitoring and shifting to new regulations, you should also consider if the bank or payment processors mention that they have extensive experience with high risk merchants.

This is important because if they don’t, there may be a mismanagement of expectations on your end and theirs. You may be expecting them to accept a potentially high chargeback rate of your CBD products, and they may be only willing to capitalize on a trend, but not take a big risk.

This is why assessment beforehand and research are very important.

4.Be prepared when applying

You’ve considered your options, and now you’re ready to take the next step.

It’s now time for you to apply to the CBD friendly bank, but there are a few things you’ll have to consider beforehand. You will probably be considered a marijuana related business (MRB) at the bank during the application process, and as mentioned earlier, you will be considered high risk. This will lead to more scrutiny, so you need to be prepared.

You need to have a plan you can explain to address potentially high chargebacks, because this is still unfortunately an industry where customer satisfaction can vary even with your best intentions, and card-not present transactions (CNP) could occur.

You’ll also want to make sure that you have legal documents on hand to prove that your CBD product is created within the confines of the current law.

This is very important, because as mentioned earlier, the THC level will determine the legality of your product. At the end of the day, you need to do whatever you can to demonstrate that you are a good actor in the green rush, because banks may have a hard time differentiating between a scammer and a quality business.

This is why honesty and integrity are the best policy. Being transparent about your operations about changes within your business will help you avoid suspicions of fraud, having detailed documents will help keep things clear, and ultimately playing by the rules by avoiding legal loopholes that can come back to haunt you are some best practices to operate by.

5.Some banks/credit union that accept CBD businesses

So by this point you’ve done your research, and you’re prepared to do an application.

Maybe you already have some banks in mind, but in case you’re drawing a blank or are having trouble finding or choosing one, we figured we ‘d give you a few suggestions of some CBD friendly banks, and more specifically credit unions…

Partner Colorado Credit Union

Through their Safe Harbor program, this credit union has been accepting cannabis accounts since 2017, and is proving to be an ally to the CBD world. This is especially true considering that their CEO, Sundie Seefriend postponed her retirement to continue helping businesses in this growing industry.

Salal Credit Union

This is another great credit union that may prove beneficial for your business. They offer a wide array of services such as employee accounts, cash pickup and delivery services, and loans needed for capital related to your CBD business needs; not to mention you’ll even get a designated account manager to help you with all of this too! Keep in mind however, that you need to have your business operate in the Washington and Oregan area, and also have solid finances and credit to have the best chance of being accepted.

Timberland Bank

Yet another ally to CBD businesses, Timberland has been found to offer its banking services to this industry. Although this bank has been in business for over 100 years and can be reliable, they don’t seem to openly say that they work with the industry, and don’t appear to advertise it on their website. Regardless, SEC filings have demonstrated that they do have bank accounts from marijuana affiliated businesses, so an opportunity may be there for you.

Chase bank

Surprisingly, a large bank like Chase has also decided to jump onto the Cannabis bandwagon, but it seems like they are in the early stages so far. CBD-related bank accounts are allowed, but they haven’t yet allowed payment processing businesses within this industry. Considering their size and popularity, they want to protect their reputation and profits, so they will likely wait for legislation like the SAFE banking act to pass before moving any further. They could prove to be an ally to the CBD industry in the future, but only time will tell when or if they ever make the move to fully opening their services to this growing industry.

North Bay Credit Union

This is another credit union that jumped on the cannabis trend starting in 2017. Located in California, North Bay offers checking accounts for cannabis businesses, but also for businesses specifically selling hemp or CBD products. Keep in mind however that there is a non-refundable application fee of $1000, a monthly fee of $500, and your business should operate in Napa, Solano County, Marin or Sonoma county. In addition to price and location, being a member of the California Cannabis Industry Association (CCIA), the National Cannabis Industry Association (NCIA), or the Sonoma County Farm Bureau will also make you eligible for membership.

Numerica Credit Union

Since 2014, Numerica has been a pioneer in the industry as they were one of the first credit unions to consider working with the CBD industry. This is a great credit union to be a part of for your CBD business, but one downside is that they mainly only serve businesses who reside in Washington. If you live outside the state, this won’t be a feasible option, but if you reside there, it can be an opportunity.

Summary

In short, finding a bank in this industry could prove to be challenging, even after the passing of the 2018 Farm bill. However, there are still opportunities, and the cannabis industry will likely continue to rise and gain favor within the banking industry as consumer attitudes shift, tastes change, and legislation follows along to regulate.

Legal status is the biggest concern for CBD businesses at the moment, and inconsistencies between state and federal legislation can prove to be damaging to business operations, making traditional banks consider you to be a higher risk than you already are.

This is why knowing your jurisdiction’s laws, knowing what issues face eCommerce CBD retailers and planning for your application will be crucial to your success.

The future looks promising for CBD, and according to Forbes, it’s projected to reach nearly $20 billion by the middle of this decade.

Are you ready for this opportunity?