In order to accurately read your merchant processing statement, it is important to understand that three parties are being paid for every transaction conducted. The first party is the major card brands, Visa, Mastercard, etc. These fees are called “card brand assessments” and they are 0.13-0.14% + $0.0155-$0.0195 per transaction. The second party is the card holder’s bank; this fee is called “interchange” and the fee varies based on the card type used (debit, credit, rewards card, etc) and how the transaction took place (online vs in person). Interchange rates range between 0% + $0.10 to as high as 2.70% + $0.10 per transaction. Debit and bank cards fall into the lowest tiers on the interchange rate tables, while rewards cards and international cards are in the higher tiers. Likewise, card present transactions are in the lowest interchange tiers, while card not present transactions (online, over the phone) are in the higher tiers. Visa’s current interchange rate table is available here as a guide.

The final party that is compensated is your merchant processor. The fees assessed by your processor will vary based on the billing model used, and the fees here vary widely; from 0.1% to as high as 5% on top of interchange and card brand assessments.

Pricing Models

There are three pricing models used by merchant processors: flat rate, interchange plus and tiered. Flat rate is simple and the easiest to understand. With flat rate billing, your merchant processor will assess a single rate (i.e. 3.99% + $0.25/transaction). The card brand assessment and interchange are deducted from this, and your processor keeps anything left over. Depending on the processing rate, flat rate billing can be the most costly billing model for your business.

With interchange-plus pricing, your merchant processor assesses their own separate fee, on top of interchange and the card brand assessment. Interchange-plus is the most transparent and cost effective method of billing, but is not always available as an option, particularly for high risk merchants.

The third method, tiered pricing, breaks up interchange into three tiers and assesses a rate to each tier. The tiers are qualified (lowest rate), mid-qualified, and non-qualified (highest rate). Generally tiered pricing for high risk merchants will look something like:

- Qualified (aka Qual): 3.95% + $0.25

- Mid-Qualified (aka mid-qual): 4.45% + $0.25

- Non-Qualified (aka non-qual): 5.45% + $0.25

Depending on the type of card and how the transaction took place, your transactions will be priced in one of these three tiers. For online merchants, most transactions will fall into the mid or non-qual tiers; card not present transactions will just not qualify for the qual tier due to their heightened risk.

So, to read your statement accurately, you need to know what your rate is. The easiest way to find this is to refer to your original merchant account application. You’ll want to note your billing model (flat rate, interchange plus, or tiered) and the rate your processor is charging you.

Other Fees

The discount rate and per transaction fees discussed above comprise the majority of the cost for processing your transaction, but there are other fees and assessments to consider.

Statement fee

Most processors assess a monthly processing fee for statements. The monthly statement fee is usually around $10 and is for the administration required to produce and deliver your statement.

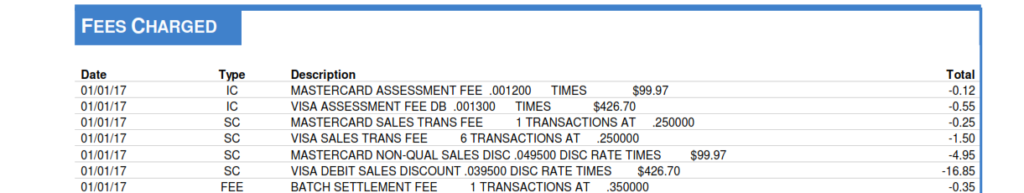

Batch settlement fee

At the end of each day, all your transactions are ground together in a batch and settled to your bank account. Your batch settlement fee is assessed for every day there are transactions to settle. The batch fee is normally under $0.50 per batch.

Chargeback fee

A chargeback fee is assessed for every chargeback on your merchant account. Normally, chargeback fees range from $25-$45 per chargeback. In cases where chargebacks have exceeded the processor’s threshold, the processor may assess an additional fee for chargebacks that have exceeded the threshold.

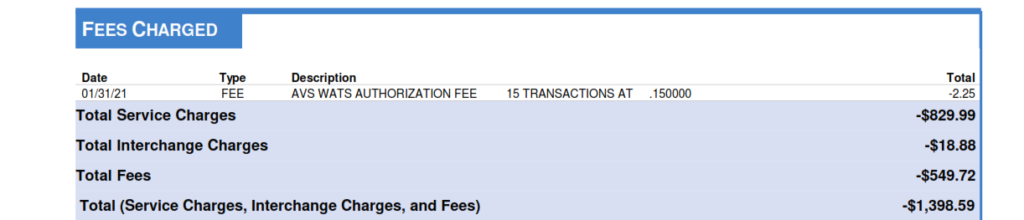

AVS Authorization fee

AVS (Address Verification Service) is a service that checks the cardholder’s address on file against the address submitted with the transaction. This service is used to reduce fraud, is assessed on a per transaction basis, and is usually $0.10-$0.15 per transaction.

Application fee

Depending on your processor’s application policy, you may be assessed a one-time application fee. Application fees are normally $50-$100.

PCI non-compliance fee

PCI compliance is an annual check on security and practices for your organization. Every year, merchants must complete a PCI audit in order to remain in compliance with the Payment Card Industry regulations. If you have not completed your annual PCI compliance or are non-compliant, your processor may assess a monthly fee for non compliance.

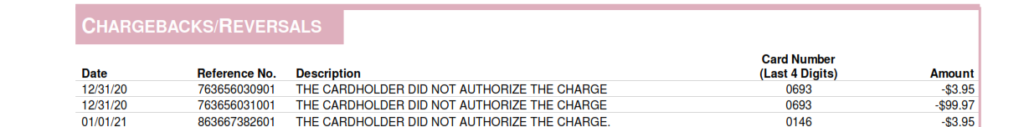

Chargebacks, refunds, reserve and any other adjustments

In addition to fees, your statement may show other adjustments, depending on your activity. Refunds and charged-back transactions, for example, will be shown as deductions on your statement. Depending on your merchant account agreement, you may also be required to hold some funds in reserve to off set the risk to your processor. Reserves are deducted from your batches and held in a separate, non-interest-bearing account until maturity.

How to Read Your Statement

Merchant processing statements vary widely with how fees and assessments are presented. With your current payment processing rates in hand (see above), you are prepared to wade through your processing statement. The key areas to check are as follows:

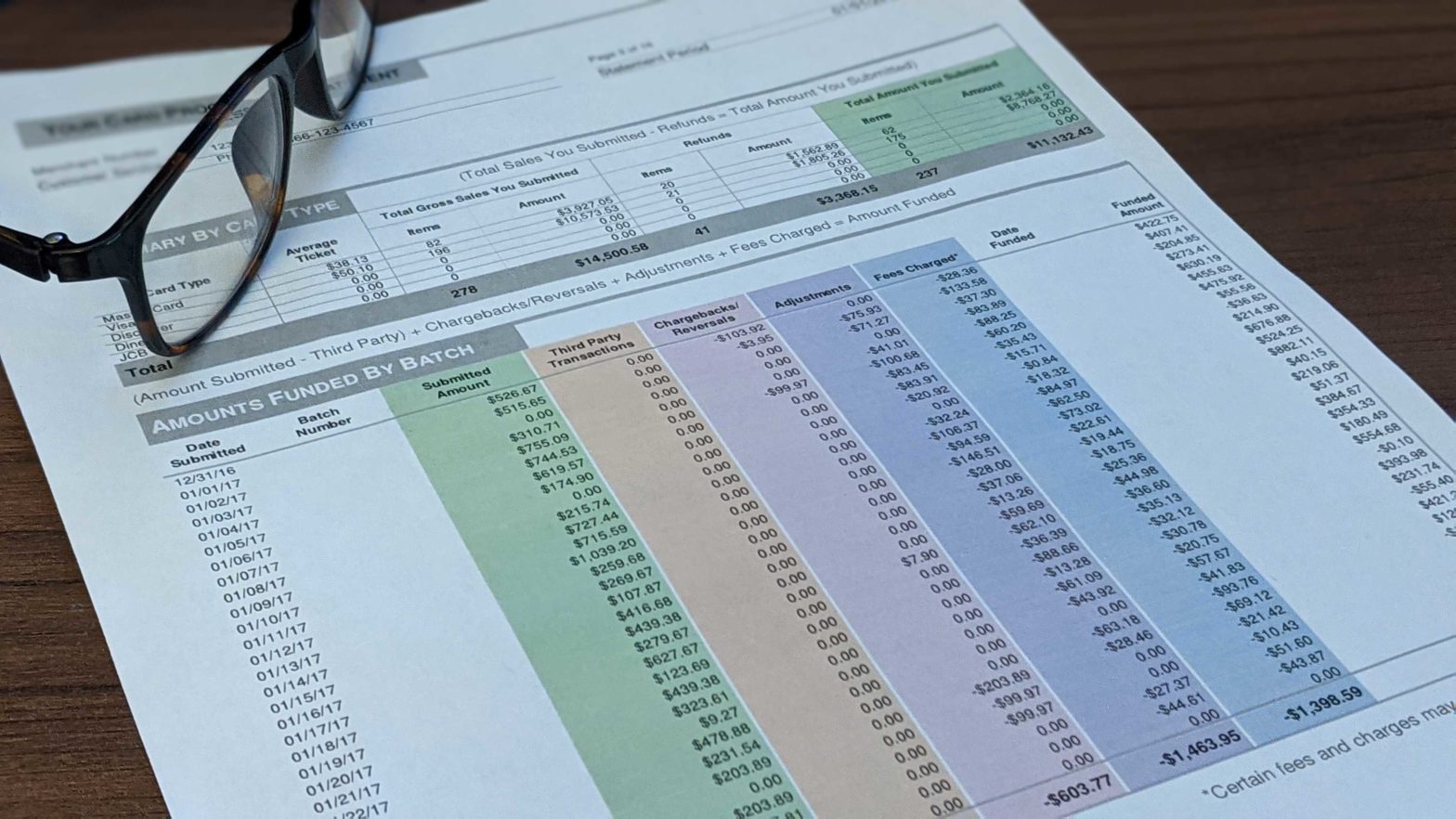

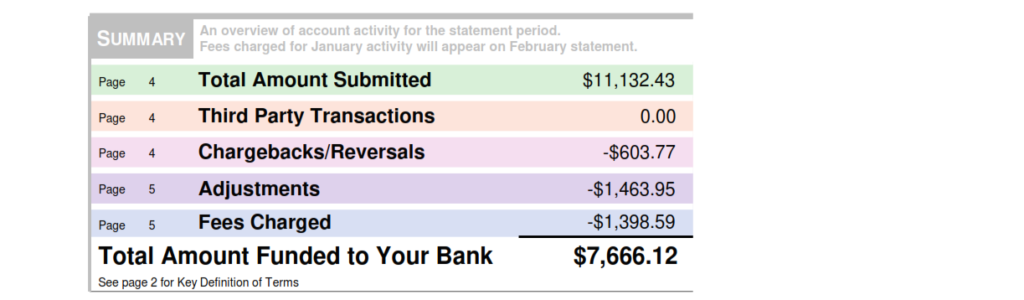

Processing summary

Your processing summary usually appears at the beginning of your statement and will show the gross sales processed, the total fees charged, and total assessments.

Fees charged

Your statement will most likely show a daily account of fees and assessments. Looking through your batches, you’ll see the details behind your billing, including the interchange tier used to price the transactions.

The detailed view of fees can be a bit cumbersome to analyze. It may be more useful to check the fees summary, which usually appears at the end of your merchant processing statement.

Chargebacks and Reversals

Chargebacks and refunds that are deducted from your batches will appear in a separate section of your statement, because these are not fees, but refunds to your customers.

Additional Help is Available

If you have any questions about how to read your statement, feel free to contact us through email, live chat, or call 888-927-4026.